Factors Influencing Decision-Making in Parity Competitive Products

It is interesting when you work in a competitive technology space, exploring how decisions are arrived at, especially in terms of customer technology choices.

As individuals, we face these challenges regularly, perhaps not even really thinking about the process much. We do it, by choosing appliances, mobile phones, cars, houses, etc. Our choices and decisions about products are influenced by a complex interplay of cognitive, emotional, social, and situational factors.

Researchers delve ever deeper into trying to understand these dynamics to help businesses create more effective marketing strategies and to aid policymakers in promoting informed decision-making among consumers but in the end, we don’t seem to really have a magic formula for how we settle on a decision.

In the corporate world, the same challenge for consumers is of selecting the most suitable technology solutions to meet their specific needs and objectives. Whether it’s for software, hardware, or other IT solutions, the decision-making process is often complex and critical for success, both personally, and for the organization.

In cases where competing technologies exhibit similar functionality and capabilities, additional factors become crucial in influencing the final selection. Consider the significance of various factors in the decision-making process, including the character and personality of the customer account manager, the presales consultant, the engagement process, pricing, company size, customer references, and other pertinent aspects, all of which, in my experience, influence the final outcome.

Picking and choosing

Organizationally, defining a need and a budget is often the starting point. Something doesn’t work, something is broken, or something is problematic. The idea might be to automate, it may be to replace or renew. When organizations seek particular technology solutions they will typically define requirements and objectives clearly.

The framing of the problem is often part of the budget-requesting process but sometimes the solution is already conceived and the problem or problem statement is already relegated. Appropriate requirements definition involves understanding the specific problems to be solved, suggesting the desired outcomes, and trying to arrive at the key performance indicators (KPIs) that will be used to measure the success of the chosen solution. If you don’t have a problem statement and you don’t have success measures then you likely don’t have a clear vision.

This may seem incredibly obvious, but if we again revert to thinking like a consumer, if you want to replace your refrigerator, you must be clear as to why you want to replace it. You may have experienced a windfall, but what is the problem with the fridge you have? You may have moved, and have no room for your old fridge or no fridge at all, or your existing fridge may actually be defective or broken. Your problem statement likely isn’t “I have money to burn – I will buy a fridge” it has to be something else. As an organization there has to be a clear vision about what problems are to be solved through the acquisition, this in turn initiates an evaluation and selection process.

Requests

For big corporate purchases, there is the RFI, RFP, RFQ process. Some have all of these, some have just a couple of these and the thresholds vary according to the specific purchasing policies.

An organization may start by issuing a Request for Information (RFI) to potential vendors. This initial step helps gather general information about products and solutions available in the market. The RFI allows the vendor to provide high-level overviews of offerings, giving the organization a broad understanding of what is available. The trigger for an RFI is often off the back of preliminary or cursory research. Using industry analyst insights, using comparison sites, or simply familiarity with particular technology vendors.

After the RFI phase (which might be skipped altogether), the organization may choose to issue a Request for Proposal (RFP) or Request for Quotation (RFQ) to a select group of vendors. These documents contain detailed specifications, requirements, and evaluation criteria.

Vendors respond with comprehensive proposals outlining how their technology solutions align with the organization’s needs. Invited participants may need to sign non-disclosure agreements (NDA) or may choose to ignore the RFP/RFQ entirely because they determine the prospective customer is not their ideal customer or because the expectations of the request are misaligned with their capabilities.

My first exposure to “tenders” was back in the late 1980’s when I participated in a closed technology consulting services tender to a governmental tourism department. Naively, I was pretty confident about my abilities and those of my partners, in being able to deliver a comprehensive and coherent service that was perfectly framed in the requirements document. What I hadn’t considered, was who I would be competing with and their approach to providing proof of past successes. The price of effectively the offer, it seemed, would not be the only selection criteria.

So this then, brings us to the competitive selection process. It isn’t always a bidding war. In cases where the RFP/RFQ responses reveal that multiple technology solutions demonstrate parity with similar functionality and capabilities, the decision-making process is more intricate. Identifying the subtle differentiators among competing products needs careful consideration in selecting the best-fit solution.

The hard comparisons

Exposure to the UI is often had, by asking for live or recorded demonstrations. Though these are often delivered in a heavily managed way, the User experience (UX) is a significant factor that can sway the decision. A technology solution that appears to be intuitive, user-friendly, and purportedly requires minimal training for employees will likely be preferred over one that is complex and seemingly difficult to navigate. Usability assessments, user testing, and interface evaluations may be the next step and may help gauge the product’s intuitiveness and its potential impact on productivity. These typically occur, when using evaluations, asking for Proof of Concept (POC) demos, or the like.

The ability of a technology solution to seamlessly integrate with the organization’s existing systems and infrastructure can significantly impact its perceived value. It is one thing to say or respond that the integration is there, it is another thing when the integration is physically demonstrated or proven. Compatibility and interoperability are often essential considerations, they can reduce implementation complexity and overall cost. Organizations assess the extent of existing integrations, the ease of connecting with a new solution, and the potential for future integration needs or promises.

Scale is important too. Organizations often prioritize solutions that can grow and adapt to future needs and growth. A technology solution that can accommodate expansion and changes in requirements ultimately offers longer-term value. Scalability assessments involve evaluating how the solution performs under various load scenarios, such as increased user counts or expanded datasets or integrations are also something which may be tested or require detailed testing evidence.

The level of support and maintenance offered by the vendor can heavily influence the decision. A responsive support team and well-defined service level agreements (SLAs) are often deemed critical, especially in complex technology implementations. The availability of a 24/7 help desk, an online knowledge base, and timely issue resolution are aspects that can significantly impact the organization’s overall satisfaction with the vendor.

Softer comparators

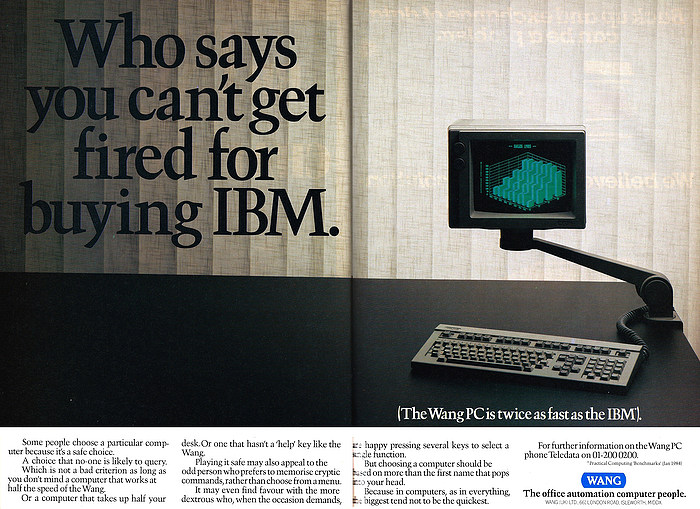

Execs often don’t like to hear that people count. The preferred perspective is that the solution and the company’s reputation stand for itself. The idea that buying IBM for example was a safe technology bet, was something that was echoed in many IT dept halls in the 1960s, ’70s and ’80s even though it was never actually the company’s tagline. Though IBM never used the phrase in advertising, some strap lines did allude to it: “At IBM, we sell a good night’s sleep.” per Origin.

“It was thought up by someone in corporate America cleverly commentating on the danger to one’s job when selecting pricey software that… didn’t quite pan out.” opines Cole Shafer on Honey Copy.

Another view might say, well if you’re spending your time looking for something that is likely tried and tested, go with one of the “big boys” as opposed to a Wang, RCA, Data General, Digital Equipment Corporation (DEC), Control Data Corporation (CDC), Scientific Data Systems (SDS/Xerox) who, like the below mid-1980s advert from Wang might use the phrase to explain away a failed tender to their own execs.

.

But consider yet another perspective the one where the prospective customer chases the underdog because they feel that they have a greater ability to influence the design, feel, and roadmap of a particular product because they feel that they might have leverage. This may seem counter intuitive, but it is definitely a potential factor to consider. Assuming that because you’re the underdog you don’t have a chance, may be the wrong assumption to make.

When technology solutions reach parity in functionality and capabilities, various other factors play pivotal roles in the decision-making process and some of these are unpalatably soft for execs to stomach.

The Midas touch

The personality, knowledge, expertise, and responsiveness of the customer account manager and presales consultant can leave a lasting impact on the prospect.

A strong relationship with the vendor’s representatives instills confidence in the partnership and can lead to better collaboration throughout the deal brokerage, the implementation, and beyond.

Organizations will often indirectly look for account managers and consultants who take the time to understand their unique challenges and propose appropriately tailored solutions or product positioning that align with their specific needs.

An empathetic approach that focuses on building trust and addressing concerns can ultimately be a deal-maker since it fosters a more positive and productive relationship between vendor and client.

The engagement process proposed by the vendor, including project management methodologies and communication practices, is also crucial.

A well-structured engagement plan can lead to smoother implementations and successful outcomes, basically describing to the buyer, how you plan to present your organization and offerings to the prospect.

Organizations often evaluate the vendor’s approach to project management, by looking at how they manage the opportunity as a project, including the allocation of presales and supplementary support resources, communication frequency, and risk mitigation strategies.

Effective project management processes even in the sales cycle, help ensure that the pitch stays on track and that potential derailing issues are addressed promptly.

While pricing is always going to be a factor, it becomes even more crucial when technologies are at parity. Organizations may consider other factors such as the spread of costs, including upfront costs, ongoing maintenance expenses, licensing models, and potential hidden costs.

An unseen (by the vendor) comprehensive cost-benefit analysis may be conducted, considering both short-term and long-term financial implications. This means, that as the seller you must strike a balance between budget constraints and the perceived value of the technology solution.

It’s hard to be bigger than you are, but the size and reputation of the vendor’s company is influential.

Established companies with a strong track record of successful implementations and a significant customer base may be perceived as more reliable. However, smaller companies with niche expertise may also offer unique advantages, such as personalized service and a higher level of attention to individual client needs. Organizations must evaluate their risk tolerance and assess the potential benefits and drawbacks associated with companies of different sizes.

A way to compensate for size is with physical and written, and telephonic references. Customer references and case studies provide valuable insights into real-world experiences with the solution.

Organizations often seek feedback from existing customers to gauge satisfaction and success rates. Engaging in conversations with references allows the organization to ask specific questions related to its unique requirements, implementation challenges, and the vendor’s responsiveness to their needs. Additionally, case studies that showcase successful implementations in organizations with similar profiles offer valuable validation of the technology’s suitability.

Pudding time

Some technology vendors simply won’t entertain a PoC at all. The rationale for not offering a PoC is legion. Among them, the endless PoC with seemingly infinite levels of scope creep, poorly articulated success criteria, costs to serve, deciding how to support etc

A Proof of Concept (PoC) can be a powerful tool in the decision-making process. It allows the organization to evaluate how the technology performs against specific expectations and for specific use cases before making a final commitment.

A well-designed PoC should focus on validating critical aspects, such as performance, security, scalability, and integration capabilities but success hinges on organizations working closely with the vendor to define clear success criteria for the PoC to ensure that the evaluation process remains objective and aligned with their objectives.

Communication

This is really more, of the softer stuff, but ultimately it needs to be acknowledged that in technology decision-making, the human element plays a significant enough role in shaping perceptions and building trust that it is not uncommon to see vendors roll in a larger cast of characters as the opportunity manager see the deal teeter on a buy/abandon decision.

In my days as a customer and working on the vendor side, the “suits” would often arrive when special encouragement or reassurances were needed. I was always amused for example, by the chocolate brown suits that the IBM account execs would often wear, and the shiny blue suits that the guys from SAP would often be seen wearing. I don’t remember the ones the Compaq and HP guys wore but everyone was in a suit!

The most competent account managers and presales consultants who genuinely understand the organization’s pain points and challenges pitch and propose solutions that resonate resoundingly with the organization’s objectives. They’re active listeners and respond when asked, as opposed to those who might listen to respond. Assuaging an organization’s concerns, asking clarifying questions, and demonstrating empathy for the challenges the organization faces all help in developing a deeper understanding of the organization’s unique context.

Effective communication and responsiveness build confidence in the vendor’s ability to address any concerns or issues that may arise. Timely responses to queries and proactive communication foster a sense of partnership and reliability. Candid and transparent communication about timelines, milestones, and potential risks helps manage expectations and allows the organization to plan accordingly.

Big purchases are all about partnerships rather than just transactions. A long-term commitment from the vendor fosters a sense of security and suggests a culture of collaboration. Vendors that demonstrate a vested interest in the organization’s success are perceived to be more likely to provide good ongoing support, upgrades, and enhancements, and commit to collaborate on future initiatives.

To foster a long-term partnership, organizations will always seek out vendors who prioritize customer success and demonstrate a commitment to continuous improvement.

What’s your perspective, or do you think it is all a perfect confluence of timing, product, price place, and people – essentially luck?